PENSION PLAN ADVICE

How our service works

We’ll help you take control of your pension. First, we’ll tell you the best place to invest your pensions and then we’ll transfer old pensions into your new plan and set up regular contributions.

Set up a personalised pension plan

The first step towards a better pension only takes a few minutes. Simply sign up with a few details about yourself and answer some quick and easy pension questions, like when you plan to retire, or if ESG investing (socially responsible investing) is important to you.

As soon as you do that, you’ll receive your tailored pension plan, using funds selected from the whole of the market, and we’ll introduce you to your dedicated Pension Adviser.

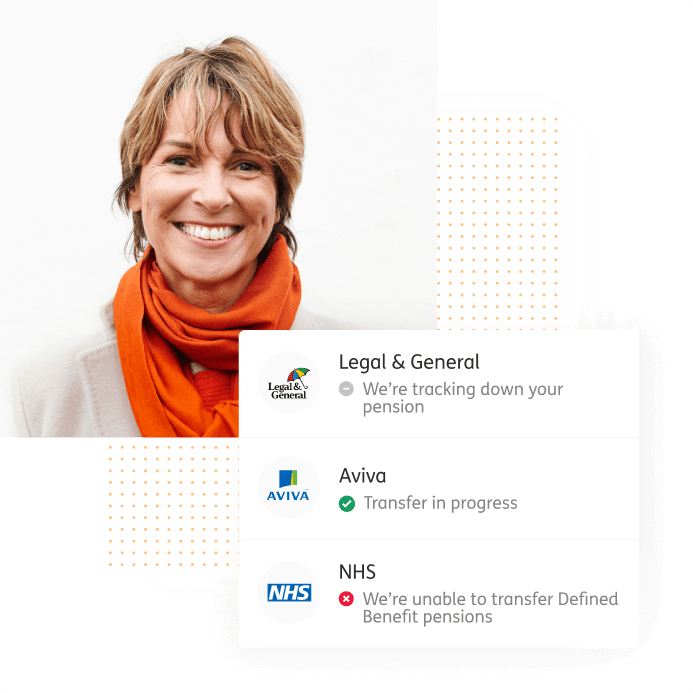

Combine or transfer old pensions into your new online plan

Then in your online account tell us about any pensions you would like to combine into your new pension plan. If you know your old pension details, there’s no fee and we’ll then take care of the rest by contacting your providers and arranging the transfer on your behalf. If you need a bit more help and need us to track down lost pensions or check for benefits, you’ll pay a one-off fee of 1% of the pension value (taken from the pension upon transfer).

Start a new pension

Even if you don’t have any old pensions to transfer and combine, you can also start a completely new private pension and add money into your new personalised pension plan. Just set up regular or one off contributions and you’ll get tax relief from the government automatically applied, which means a 25% top-up on your contributions for basic rate taxpayers.

Ongoing advice service

Our work isn’t over when we’ve started your new pension and transferred your old ones. Our ongoing advice service continues to monitor and review your pension, to keep your money working as hard as you do. Together with your dedicated Pension Adviser, we’ll make sure your pension plan is updated regularly to reflect your changing needs and what you want to get out of retirement. Just like your original personalised pension plan, our ongoing advice service is impartial and looks at the funds available from the whole of the market.

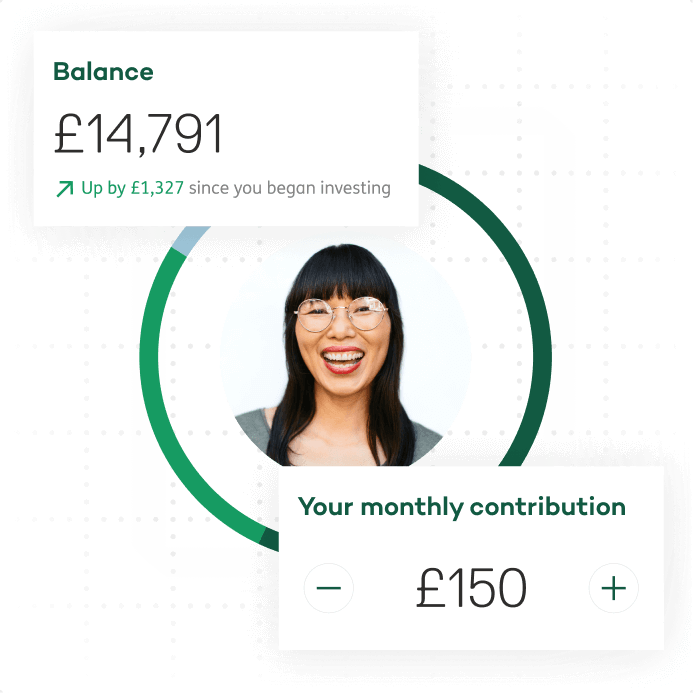

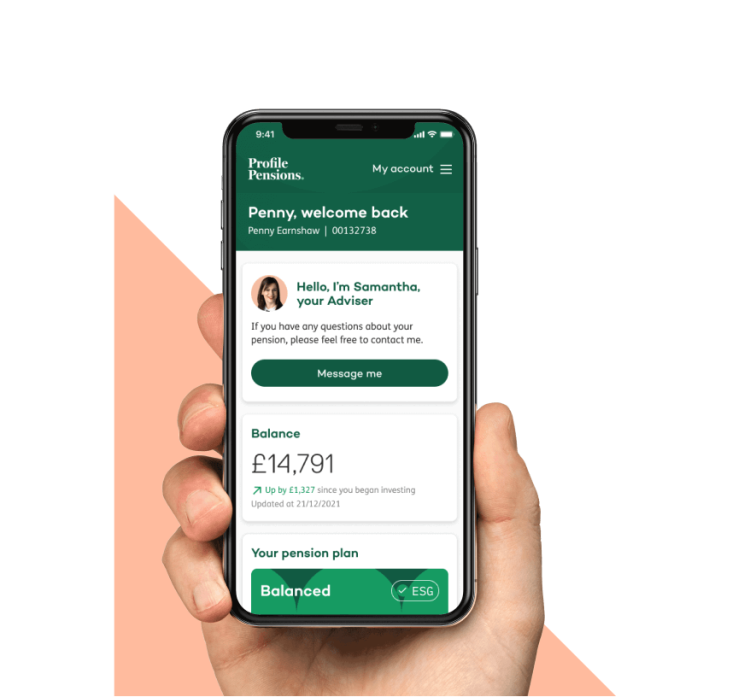

Secure online account

You’ll always have access to your secure online account to see your pension plan, the balance and the performance of your pension. You can also easily:

Privately message your dedicated Pension Adviser, who will always be happy to help

Make one-off or set up regular pension contributions

Add other pensions you know about free of charge, or ask us to help find lost pensions and check for any guarantees or protected benefits*

Plan for your retirement, including pension drawdown income

Easily keep us up to date with your details

*If you’d like us to help you find pensions or check for benefits, you’ll pay a one-off fee of 1% of the pension value (taken from pension upon transfer).

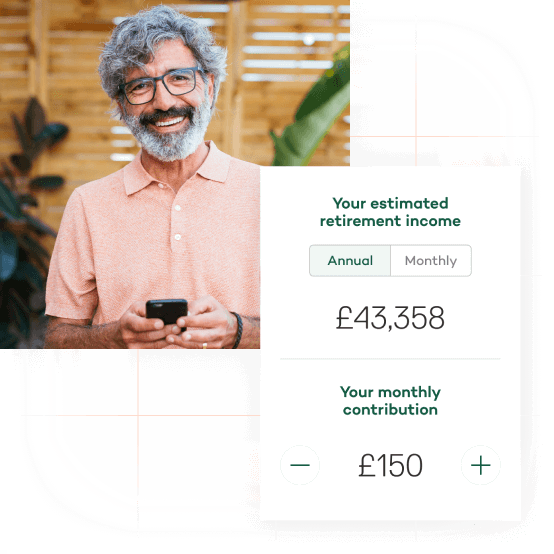

Access in retirement

From age 55 onwards (rising to 57 in 2028) you can access your pension via your online account and begin pension drawdown or take up to 25% of your pension pot as a tax free lump sum. Your tailored pension plan gives you the flexibility to access your pension and can help you withdraw from your pension with confidence.

A real-time withdrawal schedule - an estimated sustainable annual or monthly drawdown rate in your online account

Continued investment - making sure your pension benefits from the potential of further growth

Your dedicated Pension Adviser - someone is always on hand to help you with your pension

Transparent, competitive all-inclusive fees

It's free to join Profile Pensions, which means we won’t charge you for starting a new pension, making contributions or transferring and combining old pensions. We’ll only charge a one off 1% fee if you need us to track down your old pensions or if you’d like us to check for any benefits before you transfer them.

No hidden costs. Our annual fee is between 0.82%-0.86% (depending on the pension plan we choose for you). This includes platform and fund fees, plus our ongoing advice service.