ESG INVESTING

Responsible investing

A pension plan for those who want high standards of environmental sustainability and social responsibility to be reflected in how their pension is invested.

Why choose ESG?

A transparent annual fee

A competitive annual cost including our ongoing service, with platform and fund charges passed on at cost to customers.

Impartial & whole of market

We look at all funds available and remove any that overcharge or are not market-leading.

A pension that makes a difference

We only use reputable companies that embrace responsible investing.

What is ESG investing?

ESG (Environmental, Social and Governance) are non-financial factors that the investment industry has adopted to measure the sustainability and ethical impact of investments. Money invested in our recommended funds will only be used to support companies that meet our funds' strict criteria. Companies that don't will have to find other investors. The more they struggle to find investors the more likely they are to change for the better.

Our approach to ESG investing

Using your money to help change the world for the better should not come at a cost. That’s why we have worked tirelessly to make sure that you get the best value for your money. We have searched the whole marketplace filtering through all the investment managers that charge extortionate amounts or sell "green" funds that offer a surprisingly light touch. We have combined funds that truly embrace ESG in their investment process, from some of the most reputable investment managers, at a market-leading cost; fractions of the cost of the average ESG investment*. Who says ESG has to come at a premium?

* Source: Morningstar European Fee Study

What do the funds we choose exclude?

We only recommend funds that meet our high ESG standards. The funds we have chosen have a wide range of exclusions, including:

Fossil Fuels [1]

Weapons [2]

Tobacco

Companies that do not comply with the UN Global Compact Initiative [3]

[1] All of our ESG funds exclude thermal coal and oil sands, but our BlackRock global equity and corporate bond funds go further and exclude fossil fuel reserves and oil and gas equipment, services, extraction, and production.

[2] Nuclear weapons, controversial weapons, and civilian firearms.

[3] An initiative to encourage businesses worldwide to adopt sustainable and socially responsible policies.

Start making a difference to how you invest your pension today

How our service works

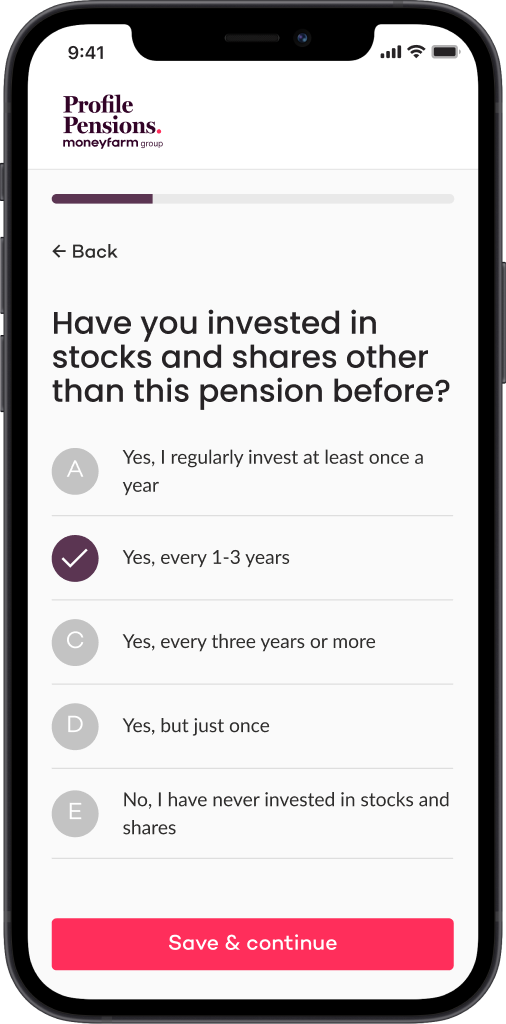

01

Sign up and get your pension plan

Answer some questions about yourself and we’ll tell you the best place to invest your pension(s).

02

Add/find pensions to transfer

03

Watch your money working harder for you