The simple, reliable way to take control of your pension. Combine, save and access (from age 55) your private pension online. Get a personalised pension plan created for you.

Take control of your pension

Combine old pensions

You can easily combine or transfer old pensions into your new plan, with no fee. If you need help tracking down old workplace pensions or want us to check for any guarantees or protected benefits, we can help for a one off fee of 1% of the pension value.

Start a new pension

Withdraw from your pension

Why choose Profile Pensions?

There’s no guesswork. We’re pension experts and will tell you the best place to invest your money, selecting funds from the whole of the market, and we'll monitor your pension on a regular basis to ensure it's in the right place for you. We’re here to help and will always work in your best interests. We can even help you track down and combine old pensions with our pension tracing service, doing all the hard work for you, for a one off fee of 1% of the pension value.

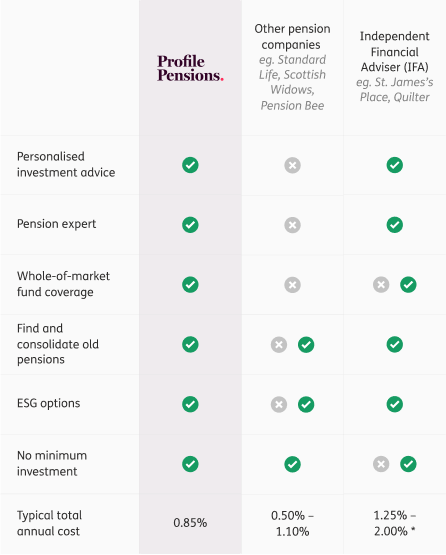

We’re so confident, we’ve compared our service to other pension providers and traditional Independent Financial Advisers in our handy comparison table, so you can see the value for money we offer and how our service stands out from the rest.

To make sure your pension is on track and you’re paying in the right amount each month, you can use our pension calculator to see what your pension could be worth and what income it could give you in retirement.

*based on average data from an Unbiased study - https://www.unbiased.co.uk/life/get-smart/cost-of-advice

The importance of pension advice

Pensions can seem complicated or intimidating, and by doing nothing or trying to self manage, you can make expensive mistakes that could cost you money and affect your retirement.

All we need are a few details and we can give you a personalised pension plan, so you can relax knowing that your pension is in the right place for you. Our ongoing service is designed to make sure your pension continues to be invested in the right place for you.

We’ll continue to monitor your pension, keeping you up to date in your secure online account, where you can see the balance and performance of your pension, message a Pension Expert directly at any time, and see how much your pension could give you in retirement.