PENSION DRAWDOWN

Withdraw from your pension with confidence

A tailored pension plan to help you understand how much you can potentially withdraw each year from your pension to last you through retirement

Why Profile Pensions?

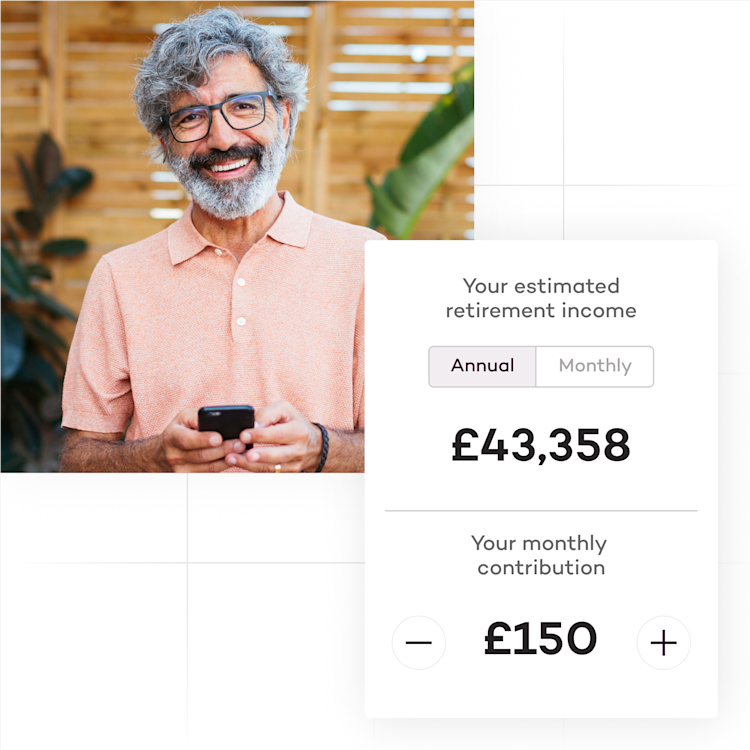

A real time drawdown rate

An estimated sustainable annual or monthly drawdown amount continuosly updated in your online account

A Pension Expert

An expert always on hand to help you with any questions

Continued investment

Making sure your pension benefits from the potential of further growth to maximise you income

What is pension drawdown?

Pension drawdown (also known as flexible-access drawdown or income drawdown) allows you to withdraw cash from your pension savings as and when you need it from the age of 55 (rising to 57 in 2028), whilst leaving the rest invested with the potential to keep growing during your retirement. This is an alternative to a classic annuity, which you purchase when you retire and get a set amount of money as an income.

What are the pros and cons of drawdown?

Simply put, pension drawdown gives you the flexibility to access money from your pension as you like, whilst allowing the remaining amount to remain invested allowing for the opportunity to potentially grow. Unlike an annuity, it also allows you to pass the full amount left in your pension pot onto a nominated beneficiary in the event of your death.

If you are looking to have a guaranteed income each year until you die, pension drawdown might not be the best option for you.

Benefits of our service

We make sure you have the right information to help you decide how much to take from your pension and when.

We’ll give you a personalised pension plan

You can see your estimated sustainable annual or monthly drawdown amount in your account in real-time

We’ll make sure we invest your money to benefit from potential further growth

A pension expert will be available to talk to whenever you need to

Arrange withdrawals from your pension through your online account or over the phone with one of our pension experts

Sign up now and get your tailored flexible pension plan today