Transferring and consolidating certain pensions can be a good idea if you're looking for an easy and simple way to manage your finances. However, before you decide to do this there are certain things you should check for, as in some cases it may be in your best interest to leave your pension where it is.

With our Transfer only service, we are not providing advice, nor will we be finding pensions or checking details of the policy(ies) for penalties and any benefits. This is a transfer only service and if you feel that this may not be the right option for you, you should consider one of our other service options, as detailed below.

Although transferring your pensions won’t change the tax benefits you receive, it could change the other benefits that you’re entitled to receive, which is why it’s important to consider whether it’s right for you. You also need to remember tax and pension rules can and do change, and their value depends on your circumstances.

This list covers some of the main things you should consider but is not exhaustive. Your decision will depend on your personal circumstances and objectives, and the characteristics of your current pension plan. Your current plan provider/administrator will be able to provide information about your current pension plan. Information about pension transfers can also be found at MoneyHelper.

Before transferring you should consider your options – check how well your existing pension scheme is performing, what fees you’re paying and whether you have a choice of different investments that suits you. Also, check whether you’ll lose any valuable benefits (see more below). If you have the investment choices you’re looking for, benefits and low fees, then check whether you’d be better off by staying where you are.

We won’t accept transfers from defined benefit schemes (such as final or average salary pension schemes), or defined contribution schemes that benefit from safeguarded benefits (like guaranteed minimum pensions), or if your employer is currently contributing to a workplace pension. If you are considering transferring in pensions, please ensure that you are not giving up valuable benefits.

Costs and Penalties

Is the new plan more expensive than your current plan? Does your current plan provider impose exit penalties or charges if you transfer or cease contributions?

The benefits of your new pension arrangements and service should outweigh any increase in cost to you or be worth the fees/penalties incurred. You should ensure that the transfer is not going to disadvantage you financially.

Find out whether there are any transfer charges or exit penalties from your existing provider if you decide to move your pension. These could be penalties or charges that relate to the pension, or the underlying investment.

Guaranteed minimum increase in pension fund

This offsets inflation, but some company schemes can make discretionary increases too.

Guaranteed spouse’s pension

Some company schemes offer a pension to your spouse once you die.

Loyalty bonuses for staying in the pension plan

These can amount to significant amounts.

Protected tax-free cash

Before pension rules changed in 2006, some pension schemes previously allowed you to withdraw more than 25% of your pension as tax-free cash. While this benefit is still protected, you’d lose this protection if you transferred your savings.

Discretionary increases to the value of the fund

Some schemes require the employer to increase the value of the fund by a specified amount, regardless of investment returns.

Market Value Adjustments (MVA) or Market Value Reduction (MVR)

These apply to ‘with profits’ investments where the allocated returns are higher than the value of the underlying investments, so if you cash them in or transfer them, a reduction is applied. Most ‘with profits’ policies have a date on which (or after which) the MVA/MVR won’t apply. But if applied they can significantly reduce the value of your pension.

With Profits

Has your current pension got exposure to a ‘with profits’ fund? You may have attractive bonus rates that could be lost on transfer. Moreover, the transfer value of ‘with profits’ funds may be subject to something called Market Value Reduction, which will reduce the size of your pension fund available to transfer.

Other benefits

Does your existing pension scheme provide life assurance, waiver of premium (a form of premium insurance) or the option of early retirement age? These may be lost on transfer. Any subsequent deterioration in your health, since these additional benefits were provided, may mean that replacement cover will be more expensive or difficult to obtain.

Is transferring to your current employer’s pension scheme an option?

If it offers the investment options you’re looking for and allows transfers, this could be a consideration as the charges may be lower or paid for by your employer. Transfers into employer schemes are not always possible but should be considered.

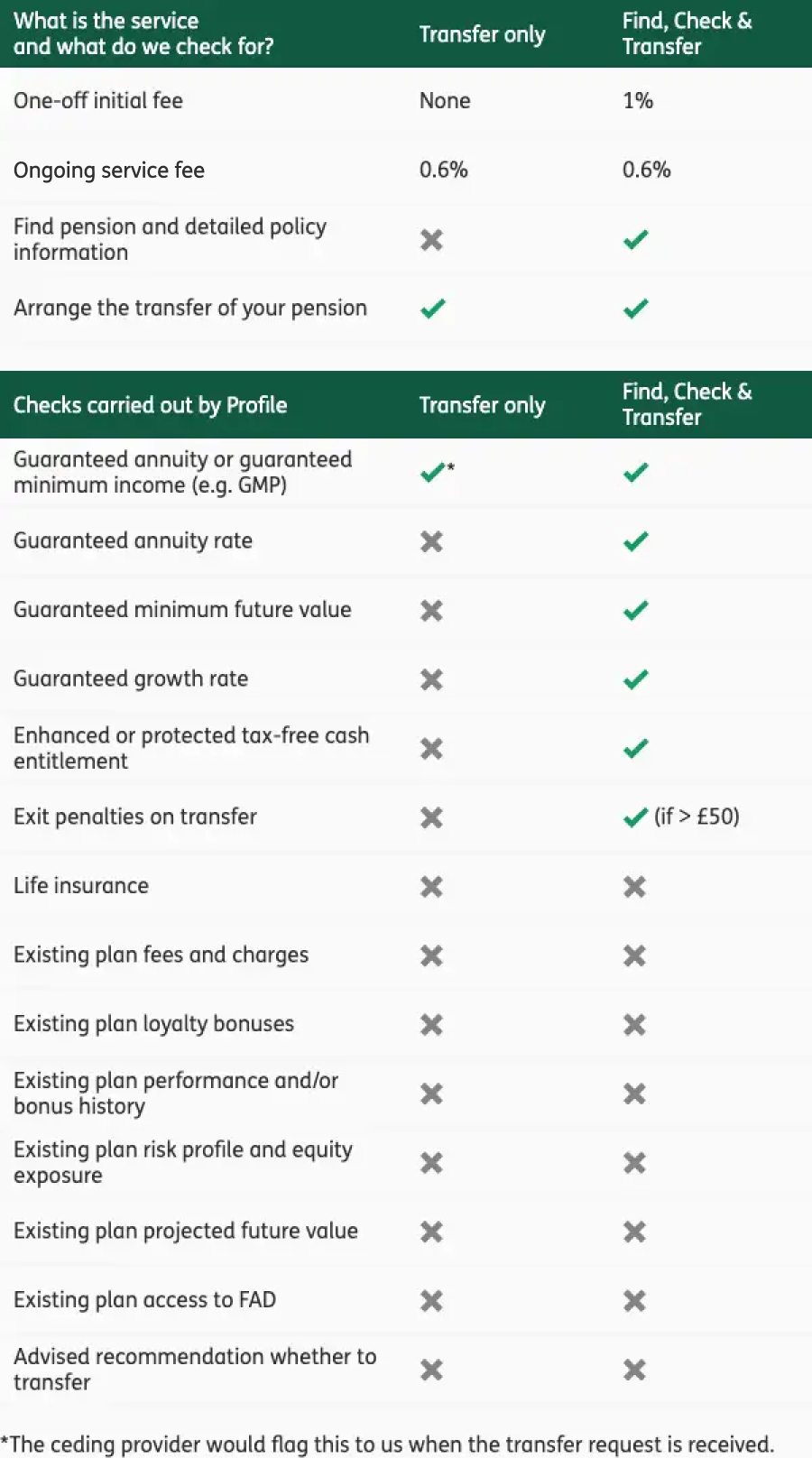

Summary of our services and what we check for: