Markets don’t like uncertainty and unfortunately events such as this can create falls in value. This has led to a negative effect on the equity investments within pensions. However, we would like to reassure our customers that the long-term outlook for their pension remains strong.

We are closely monitoring all of the pensions we look after for our customers

We know that it can be worrying to see your pension fall in value. There are a number of things to minimise the impact of these events on the pensions we manage:

Your pension is a long-term investment

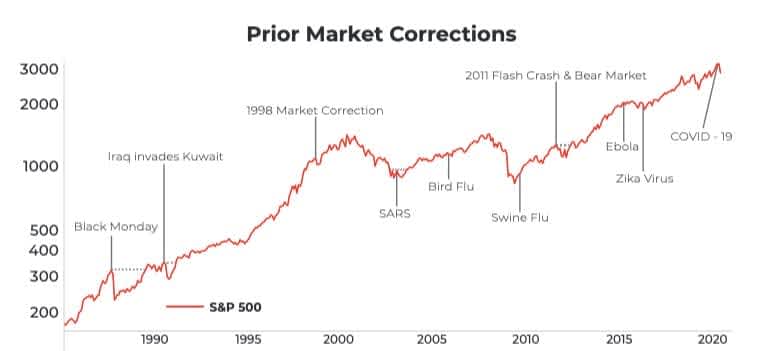

Markets tend to recover from events such as these (including SARs and bird flu in recent years) within a short period of a few months. As pensions are long-term investments it is helpful to take a long-term outlook, which is more positive.

Your money is invested across several different markets

We take into account how our recommended pension portfolios will handle events such as these before recommending them to our customers. The negative effect of the Coronavirus will hit different markets at different times and to different degrees. Spreading your investment across global markets is one of the ways that we protect our customers from these events.

Moving your pension now would remove the opportunity to recover your value

Our Investment Committee is closely reviewing shifts in global markets. General investment wisdom would not recommend you ‘sell at the bottom of the market’ as you’d miss out on the benefit of the expected economic recovery. Market crashes and recovery have happened throughout history so the key is in long-term investing.

Frequently asked questions

How often should I check my pension?

Pensions are long-term investments which means there is typically no cause to check on their value too often. As part of our ongoing service, our Investment Committee regularly review the performance of all our customers’ pensions. You are welcome to book a review appointment with one of our expert advisers at any time. We typically talk to our customers annually, or less if nothing has changed.

How long do you expect the recovery to take?

Economic evidence from similar events over recent years is very reassuring. This graph plots similar global events and shows how the recovery time is generally no more than a few months. Unless you’re planning to retire or drawdown any of your pension in the next few months this paints a very reassuring picture.

How much of my pension is impacted?

Understanding an individuals "appetite for risk" is a key part of our approach to advice. This situation is exactly why we have that conversation with every single customer. Many customers now have a balanced portfolio, with a proportion of their pension invested in equities (impacted by market increases and decreases), but also a portion invested in government bonds which are generally considered to be low risk investments.