We are different from other pension services and our aim is to cut through complex financial jargon and make sure your pension savings are working as hard as they possibly can for you.

Don’t just take our word for it. The average consumer who takes financial advice will increase their wealth by £30,991, according to research by the International Longevity Centre, so professional help could mean the difference between a comfortable retirement or finding it tricky to make ends meet.

You might decide you’d rather do it alone, but unless you’re comfortable getting to grips with technical pension terms and how different investments work, there’s a risk you could end up making expensive mistakes.

Here at Profile Pensions we use our expert knowledge and whole of market coverage to tell you the best place to invest your pensions. We look at over 40,000 funds available in the market and choose reputable and leading investment companies for people to invest their money based on your individual circumstances. As an impartial pension adviser we are not tied to or affiliated with any one provider so are always working in the best interest of their customers. We also provide an ongoing service to give you peace of mind that your pension is in the right place for you right up until retirement.

Why we differ from other pension services

We prefer to focus our service on people with smaller pension pots who without pension advice, might end up with poor retirement outcomes. Some pension services only cater for people with pension pots worth tens, or sometimes hundreds, of thousands of pounds.

To date, Profile Pensions has helped over 25,000 customers, and given advice on over £1bn of retirement funds. Of the 3,833 pensions we reviewed between January 2020 and July 2020, we were able to improve 91% of them, either by ensuring customers were moved into investments which better match their attitude for risk, or into pensions with lower charges.

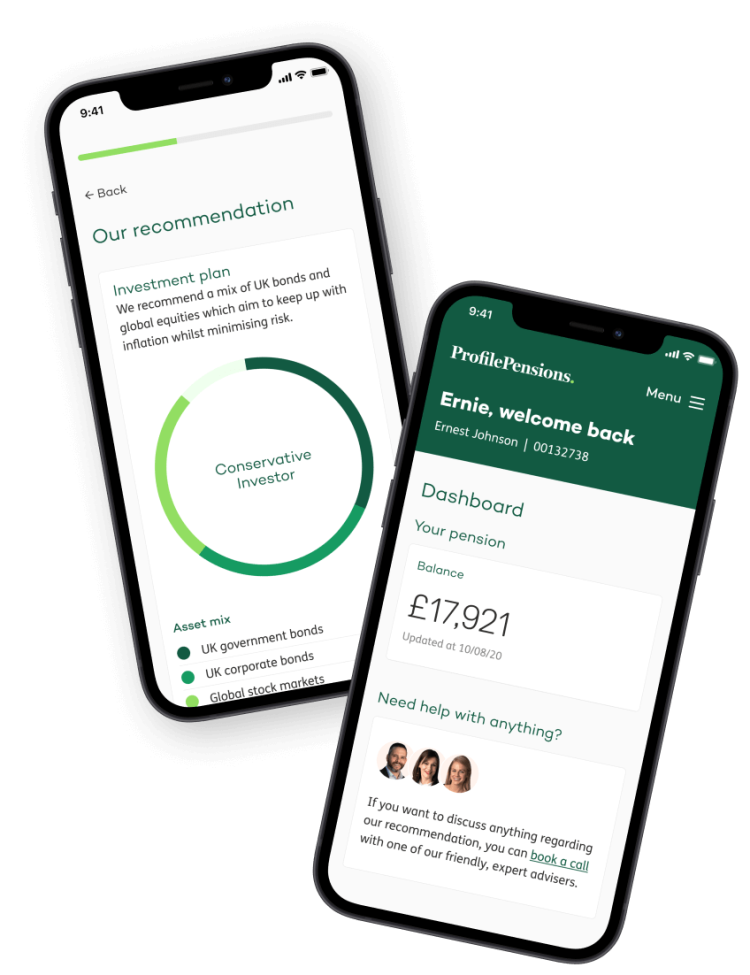

When you seek advice from Profile Pensions, you’ll be allocated a dedicated pension expert, who will focus on making sure your money is in the best possible place. You’ll be able to contact them by phone or email when you have a question, or if you prefer to manage your money online, you can simply log in to your secure account any time to view your pension information.

So, if you’ve previously discounted getting advice because you thought it was too expensive or only for those with bumper pension savings, Profile Pensions is here for you.

If you want to make sure your pensions are invested in the right way, and that you’re not paying too much in charges, spend 10 minutes today getting a free* recommended pension plan and see if you could be better off in retirement.