PENSION TRACING

Find your pensions

Changing your job or moving home can make it really easy to accidentally lose track of your pensions. Our Find, check & transfer service will help you find and combine old, lost pensions into a new pension plan tailored to your needs, to make your money work harder for your retirement.

Why Profile Pensions?

Find, check & transfer

We’ll do all the hard work - we’ll find any lost pensions for you, check for any benefits or penalties*, and then complete the transfer. (One-off 1% arrangement fee applies)

A dedicated Pension Adviser

As soon as you sign up, a pensions expert is assigned to your account - on hand to answer any questions you have, now or in the future.

We're impartial

We are not tied to anyone and choose the best funds for you available from the whole of the market.

Our pension tracing service

Since 2018 the value of lost pension pots in the UK has risen £7bn, to a staggering £26.6bn.[1] Meaning more and more people are losing track of their pensions and their money. The easiest way to do this is to find and combine all your old pensions into one, easy-to-manage pension plan.

We can help you Find, check & transfer* your old workplace pensions into a modern, flexible pension plan, that’s tailored to you. Our advice service will make sure your money is working as hard as you, so you can be better off in retirement.

*One-off 1% fee, taken from your pension when you transfer. More details here.

£26.6bn

The estimated value of unclaimed pensions in the UK [1]

£9.5k

The average value of pensions that people lose track of [1]

£35k

The average UK consumer who takes financial advice will increase their pension wealth by £35,054 [2]

[1] Pensions Policy Institute Briefing, Lost Pensions, what's the scale and impact? 2022

[2] Unbiased Advice worth nearly £5k a year over a decade, December 2022

Benefits of our service

Take control of your old pensions with our Find, check & transfer service. It’s hassle-free, easy to use and we’ll do all the work for you.

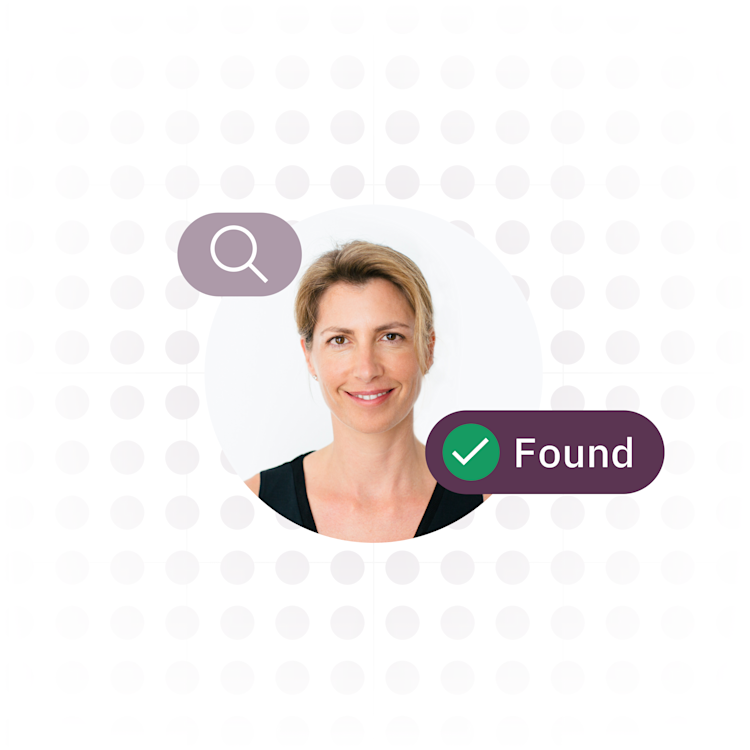

We'll find your old workplace pensions and we'll get in touch with the providers on your behalf.

We’ll also check for exit penalties and guarantees* before we transfer it

Once the checks are complete, we’ll arrange the transfer of your pension into your recommended pension plan

We only charge a one-off 1% fee for this service, which is taken from your pension when you transfer

We'll tell you the best place to invest your pensions, choosing the best funds from the whole of the market

As soon as you sign up, you'll get a dedicated Pension Adviser that you can contact if you need help or have questions

We'll continue to make sure that your pension is always in the right place for you with our ongoing service

How you can find lost pensions yourself

Missing SERPS pension? You can contact HMRC yourself and try to find lost SERPS pensions. We can also help you find out if you contracted out of SERPS by contacting HMRC on your behalf. Once we hear back from HMRC we can help you Find, Check & Transfer* any lost pensions into a new personalised pension plan.

Have lost workplace pensions? If you want to find old workplace pensions yourself, the Government Pension Tracing Service will help you identify the provider of your pension. You can then write to the provider to see if they have any old pensions in your name.

*One-off 1% fee, taken from your pension when you transfer. More details here.

Combine your old pensions into a new personalised plan today

How our service works

01

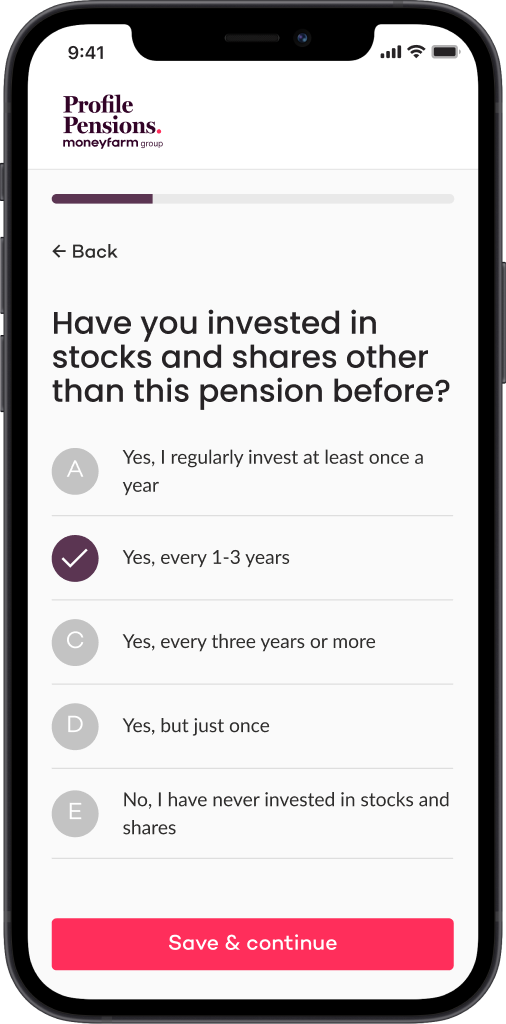

Sign up and get your recommended pension plan

Answer some questions about yourself and we’ll tell you the best place to invest your pension(s).

02

Add/find pensions to transfer

03

Watch your money working harder for you